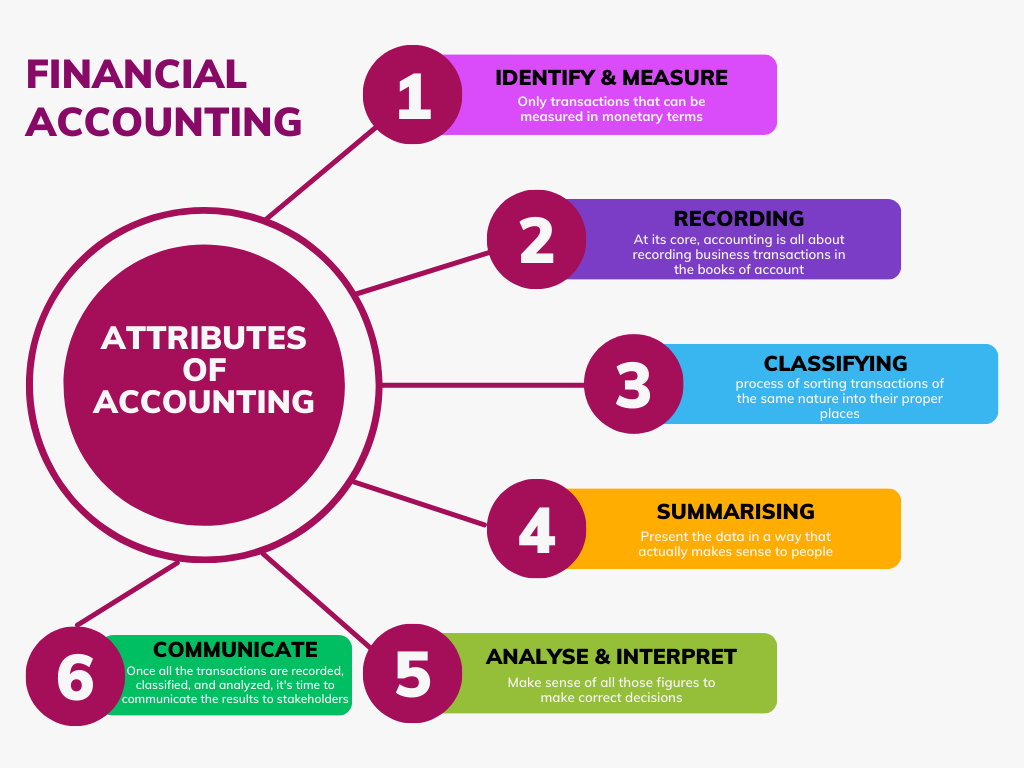

In the article defining accounting, we saw that the definitions list certain characteristics or attributes of accounting. In this article, let’s discuss each attribute in detail.

1. Identification and Measurement of Financial Transactions and Events

Accounting: If It’s Not About Money, It’s Not in the Books!

Accounting only tracks transactions and events that have a monetary value—if you can’t put a price tag on it, it doesn’t make it to the financial statements. This means accountants focus on economic activities like buying raw materials, selling products, or paying employees.

For example, if a company purchases raw materials worth $10,000 or sells finished goods for $50,000, these will be recorded because they involve cold, hard cash (or at least an invoice).

What Won’t Make It into the Accounting Records?

Not everything in business can be measured in dollars and cents. Some things, no matter how important, won’t show up in financial statements:

🚫 The CEO’s mood swings – No ledger entry for “Monday morning grumpiness” or “Friday afternoon excitement.”

🚫 Employee skills and dedication – An accountant won’t record “John is a rockstar at Excel,” even if he saves the company thousands in efficiency.

🚫 A business’s reputation – A company might be known for excellent customer service, but unless goodwill is purchased (like in a merger), there’s no line item for “we’re really nice people.”

🚫 A brilliant business idea – You may have just thought of the next billion-dollar startup, but until someone invests actual money, it remains just an idea (and accountants don’t record hopes and dreams).

In short, if there’s no money involved, accountants won’t bother with it—which is probably why no one invites them to brainstorming sessions!

2. Recording

Accounting isn’t just about numbers—it’s the art of turning business transactions into neatly organized records (and ensuring everything balances so accountants can sleep at night). At its core, accounting is all about recording business transactions in the books of account.

But not just any transaction makes the cut! Only those that have a financial character—meaning they can be measured in money terms—deserve a spot in the grand archive known as the Journal (a.k.a. the book where everything starts).

What Gets Recorded?

If a company buys office furniture for $5,000, it goes in the books. If they sell products worth $50,000, that’s in too. But if the manager spills coffee on that fancy new desk? Well, unless there’s a financial claim involved, accounting doesn’t care.

3. Classifying

Imagine dumping all your groceries into one big bag—veggies, snacks, and dairy all mixed up. Sounds like a mess, right? Well, that’s why classification in accounting exists! It’s the process of sorting transactions of the same nature into their proper places, making life (and balance sheets) a whole lot easier.

All transactions first land in the Journal (think of it as accounting’s “dumping ground”). However, to keep things tidy, these transactions are then classified and posted in the Ledger—the main book of accounts, where each financial activity gets its own dedicated account head.

How Does It Work?

Let’s say a business buys furniture for $5,000 and also pays rent for $2,000. Initially, both transactions are recorded in the Journal. However, for better organization, the Furniture Account and the Rent Account in the Ledger will each get their respective entries. That way, no one confuses office chairs with office space!

Why Bother with Classification?

✅ Keeps accounts organized – No one wants to hunt through a pile of transactions to find one payment.

✅ Helps track financial performance – You wouldn’t want sales revenue mixed up with expenses, would you?

✅ Prevents financial headaches – Imagine trying to explain to auditors why salary payments ended up in the stationery account.

So, in short, classification ensures that every transaction finds its rightful place in the grand accounting universe. Because without it, financial records would be like a teenager’s messy bedroom—impossible to navigate!

4. Summarising

Imagine you’ve just cleaned your room, sorted everything neatly, and now it’s time to show it off. That’s exactly what happens in accounting after transactions are classified—it’s time to present the data in a way that actually makes sense to people!

This step ensures that both internal users (like business owners and managers) and external users (like investors, creditors, and the tax department) can easily understand the company’s financial health.

The Grand Accounting Finale

Once transactions are recorded and classified, they take center stage in the Trial Balance—a neat little summary that helps accountants ensure everything is in order. From here, the Final Accounts (a.k.a. Financial Statements) are prepared, which include:

📌 Trading and Profit & Loss Account (or Statement of Profit and Loss for companies) – Basically, the scoreboard that tells whether a business made money or lost money.

📌 Balance Sheet – The ultimate financial selfie, showing what the business owns (assets) and owes (liabilities) at a specific point in time.

Why Does This Matter?

✅ For Business Owners – So they know if they’re growing or just burning cash on unnecessary office snacks.

✅ For Investors – So they can decide whether to pour money into the business or run for the hills.

✅ For Banks & Creditors – To check if the company can actually repay loans or if they need to prepare for excuses.

In short, presenting financial data properly turns numbers into insights, because no one wants to read a financial statement that looks like an unsolved puzzle!

5. Analysis and Interpretation

Looking at raw financial data without analysis is like staring at a recipe without knowing how to cook—it’s just numbers on a page! That’s why analysis and interpretation are crucial. They help businesses and investors make sense of all those figures and decide whether they’re looking at a gold mine or a financial disaster.

Why Bother with Analysis?

Financial statements don’t just sit there looking pretty; they tell a story. But without analysis, that story is like a book in a language you don’t understand. Financial analysis helps users:

📊 Judge Profitability – Is the company raking in cash like a hit movie, or is it struggling like a bad sequel?

📊 Assess Financial Position – Does the business have enough assets to stay afloat, or is it drowning in debt like someone maxing out their credit cards?

Examples of Financial Analysis in Action

🔹 Gross Profit Margin: If a bakery sells cakes for $50 but spends $40 making them, something is definitely wrong.

🔹 Current Ratio: If a company owes $1 million next month but only has $100K in the bank… well, let’s just say their suppliers won’t be happy!

🔹 Return on Investment (ROI): If you invest $10,000 and only make $500 back, that’s not a business—it’s a donation!

So, whether you’re an investor, business owner, or accountant, financial analysis translates numbers into real-world insights—because no one wants to make big decisions based on pure guesswork!

Communicating

Accounting isn’t just about crunching numbers—it’s also about spilling the financial tea (in a professional way, of course). Once all the transactions are recorded, classified, and analyzed, it’s time to communicate the results to those who need them.

But here’s the catch—timing is everything! Imagine getting a weather forecast after it has already rained. Useless, right? The same goes for financial information. If investors, managers, or creditors don’t get financial reports on time, they might make decisions based on outdated data, which is like navigating with an old map.

Why Timely Financial Communication Matters

📌 For Business Owners – They need to know if they can afford to expand, or if they should just focus on surviving another month.

📌 For Investors – They need to decide whether to invest or back out before things sink like the Titanic.

📌 For Banks & Creditors – They need to assess if the company can repay its loans or if they should start drafting polite but firm reminder emails.

Examples of Good & Bad Financial Communication

✅ GOOD: A company reports a strong quarter early, and investors rush in to buy shares.

❌ BAD: A company announces a major loss months late, and shareholders find out from the news instead of the financial statements. Panic ensues.

In short, accounting isn’t just about numbers—it’s about telling the right people the right story at the right time. Because in business, being late with financial info is like showing up to a wedding after the cake is gone—just disappointing!

Summary

Accounting isn’t just about spreadsheets and number crunching—it’s about making sense of financial transactions, so businesses know where they stand (and hopefully, stay afloat!). From recording and classifying transactions to analyzing and communicating financial results, every step plays a crucial role.

Here’s a quick breakdown of the accounting process, with a little humour to keep things interesting:

📌 If It’s Not About Money, It’s Not in the Books! – Only transactions with a financial value get recorded. So, no, an accountant won’t log “CEO’s Monday mood swings” or “John’s legendary Excel skills.”

📌 Recording & Classifying: Sorting Out the Financial Mess – Transactions first land in the Journal, then get neatly classified into different accounts in the Ledger—because mixing up sales revenue with office snacks expenses would be a nightmare!

📌 Summarizing & Presenting: The Grand Finale – Financial statements like the Profit & Loss Account and Balance Sheet help businesses, investors, and creditors see the big picture—like a scoreboard for a company’s financial game.

📌 Analysis & Interpretation: Reading Between the Numbers – Knowing the numbers isn’t enough; you need to figure out what they actually mean! Is a company a gold mine or a sinking ship? Ratios and financial reports tell the real story.

📌 Communication: Timing is Everything! – Financial information needs to be shared on time—because getting a financial report too late is like receiving a weather forecast after a thunderstorm!

In short, accounting helps businesses stay organized, make smart decisions, and avoid financial disasters. And while accountants may not record “hopes and dreams,” they do make sure reality checks are delivered right on time!

Leave a Reply