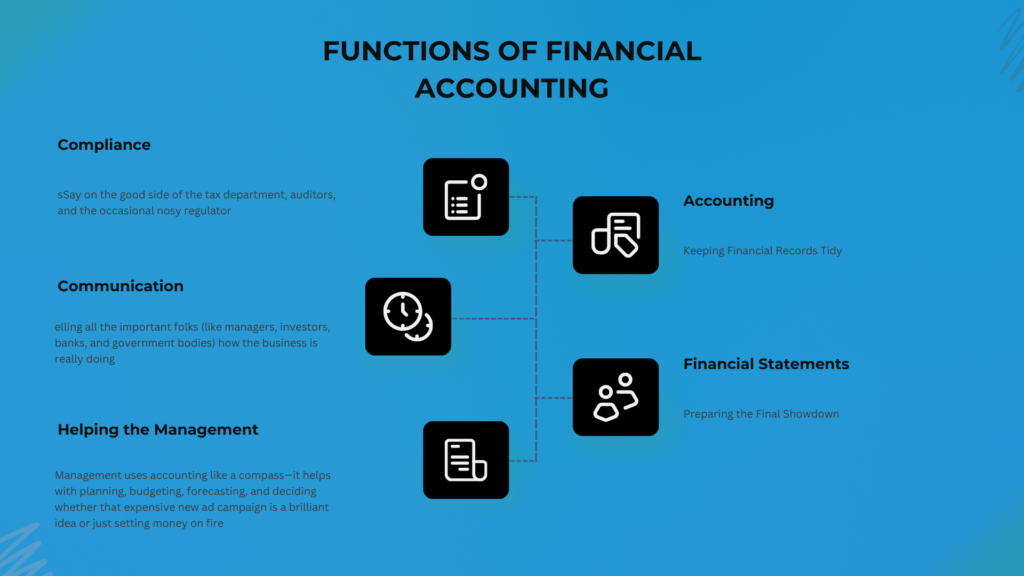

Accounting may seem like it’s all about calculators and caffeine, but it actually plays some pretty vital roles in keeping a business running smoothly (and legally). Here are the key functions of accounting:

1. Keeping Financial Records Tidy (Because Chaos is Not a Strategy)

Accounting’s first job is to record all financial transactions in an organized, systematic way. Think of it as keeping a diary—but instead of emotional outbursts, it’s full of cash flows, invoices, and expense receipts.

Example:

Bought a printer? That’s an entry. Paid for 1,000 coffee pods for the break room? Yep, that goes in too. Even the late payment penalty from your internet provider—unfortunately, that counts as well.

2. Preparing the Final Showdown: The Financial Statements

At the end of the accounting year, accounting pulls together everything it’s recorded and creates The Grand Financial Finale—also known as the Profit and Loss Account and the Balance Sheet.

Example:

The P&L tells you if your business earned a profit or just spent all its money on marketing and free pizza.

The Balance Sheet shows what you own (assets) and what you owe (liabilities)—like your financial selfie, but less filtered.

3. Playing by the Rules (a.k.a. Compliance)

Want to stay on the good side of the tax department, auditors, and the occasional nosy regulator? Accounting’s got your back. When records are kept properly using Generally Accepted Accounting Principles (GAAP), they’re not just useful—they’re also legally accepted.

Example:

If your records are neat and proper, they can be used as evidence in court. If they’re written on napkins or backed up on an uncle’s ancient laptop… well, good luck explaining that to the tax authorities.

4. Spilling the Financial Tea (a.k.a. Communication)

Accounting also acts as the financial gossip columnist—telling all the important folks (like managers, investors, banks, and government bodies) how the business is really doing.

Example:

Management finds out if they can finally approve that office renovation.

Banks decide if you’re loan-worthy or just overly optimistic.

Employees figure out whether bonuses are coming or if it’s time to update their résumés.

5. Helping the Management Stay Sane (and Make Decisions)

Management uses accounting like a compass—it helps with planning, budgeting, forecasting, and deciding whether that expensive new ad campaign is a brilliant idea or just setting money on fire.

Example:

If sales dropped by 30% last month, accounting data helps figure out if it was a seasonal dip—or if your best salesperson just joined the competition.

Conclusion

Accounting isn’t just about adding numbers—it’s about organizing chaos, informing decisions, pleasing regulators, and occasionally preventing financial disasters. Without it, businesses would be flying blind… probably into a mountain of debt.

Leave a Reply