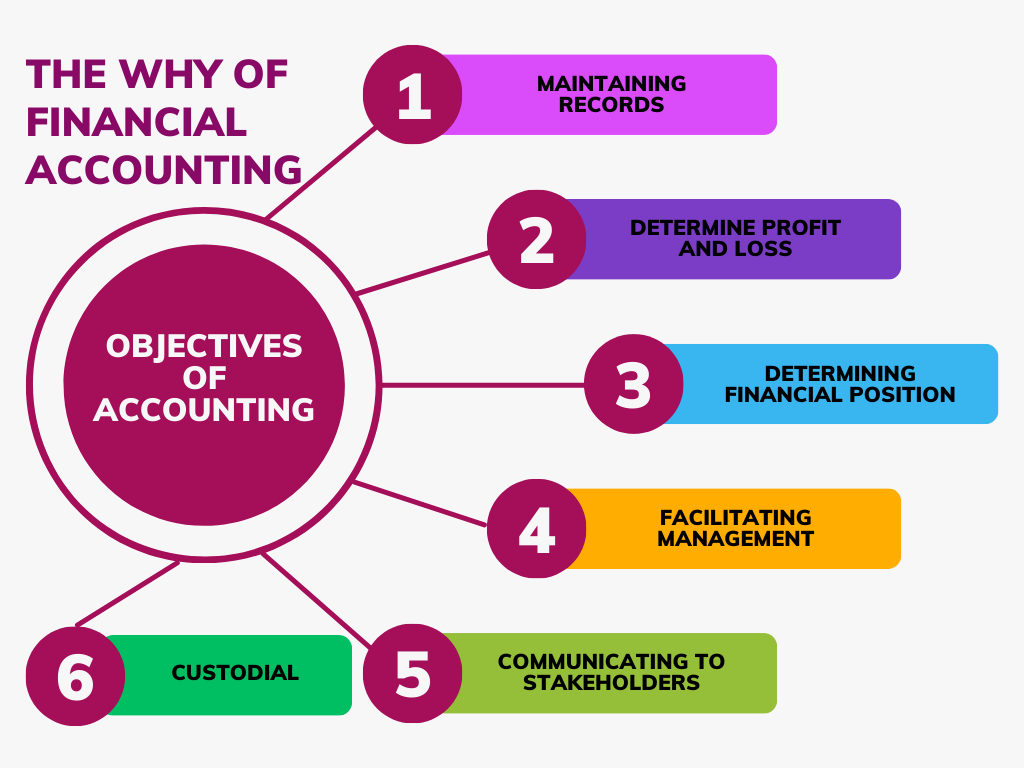

Accounting isn’t just about balancing books and crunching numbers—it’s the behind-the-scenes superhero of the business world, quietly making sense of financial chaos. Let’s walk through the objectives of accounting, one ledger entry at a time—with a few laughs along the way!

1. Keeping the Books in Order (No, Not Your Kindle Library)

The first mission of accounting is to record every financial transaction—big or small—in a neat and systematic way. Whether you’re buying office chairs or selling handmade soap online, if it involves money, it goes into the books (no exceptions for late-night Amazon purchases, sorry).

Example: If your business spends ₹10,000 on raw materials and earns ₹25,000 from sales, both get recorded. But that emotional damage from a bad client review? Not making it into the ledger.

2. Finding Out If You’re Making Money or Just Burning It

This is where the Profit and Loss Account (also called the Income Statement) comes in. It’s like a financial scoreboard that shows whether your business is thriving or barely surviving. Revenues go to the credit side, expenses to the debit—and the difference? That’s your profit… or your accountant’s “we need to talk” moment.

Example: You earned ₹5,00,000, but spent ₹4,80,000—congrats, you made a ₹20,000 profit! Enough for a victory samosa party!

3. Knowing Where You Stand (Financially, Not Existentially)

Your business might feel rich, but the Balance Sheet tells the truth. This statement lists all your assets (what you own) and liabilities (what you owe)—giving a clear snapshot of your financial position.

Example: If you have ₹10 lakhs in assets and ₹6 lakhs in liabilities, you’ve got a solid ₹4 lakh net worth. But if liabilities are more than assets… well, time to cut down on fancy office coffee.

4. Helping Management Make Smarter Decisions (And Fewer Panic Calls)

Good accounting gives management the financial info they need for planning, budgeting, and keeping the business from turning into a money pit. Without it, decisions are like playing darts in the dark—exciting, but risky.

Example: Want to launch a new product? Accounting tells you if you can afford it, or if you should just stick to your current catalog and chill.

5. Sharing Info With the People Who Care (Or at Least Pretend To)

Whether it’s the boss, investors, bankers, tax authorities, or your curious cousin who thinks you’re secretly rich—everyone wants to know how your business is doing. Accounting packages all that financial data into digestible reports.

Example: A banker checks your balance sheet before approving a loan. Your mom might check it to brag about you at kitty parties.

6. Protecting the Stuff That Keeps Your Business Running

Accounting also tracks all the assets your business owns—from laptops to delivery vans. This helps management make sure nothing “mysteriously disappears” (looking at you, office stapler thieves 👀).

Example: If your business owns 5 computers and suddenly only 4 are accounted for, accounting will catch it—unless the missing one ran away to start its own tech startup.

Final Thoughts

Accounting might seem dry on the surface, but it’s the glue that holds a business together. Whether it’s revealing profits, helping make smarter choices, or catching sneaky expenses, accounting is always working behind the scenes—like a financial ninja in a spreadsheet suit!

Leave a Reply